INTRODUCTION OF SAVEING MONEY

One of the easiest ways to save money daily is to cut unnecessary expenses, such as unused subscriptions. Save money by joining loyalty programs at stores you visit often and using cashback credit cards to earn rewards on your spending.

Saving Money Made Easy: Practical Tips for Smart Spending

Saving money doesn’t have to mean sacrificing everything you enjoy. With a few smart spending habits, you can save while still enjoying life. The key is to make intentional choices about where your money goes. Whether you’re trying to build an emergency fund, save for a vacation, or reduce debt, these tips will help you get started.

1. Create a Budget That Works for You

- Set Clear Financial Goals. Whether it’s saving for a vacation, building an emergency fund, or planning for retirement, having clear goals will help you stay motivated and focused.

- Track Your Spending.

- Use of 50/30/20 Rule to Create Budget.

- Prioritize Saving.

- Review and Adjust

Start by tracking your income and expenses to understand where your money is going. A realistic budget can guide you in making smarter spending choices. Try the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings or debt repayment. Adjust as needed to suit your goals.

Define what you’re saving for whether it’s a short-term goal like a new phone or a long-term goal like a house. Knowing your goals can motivate you to save and make you less likely to make impulsive purchases that derail your progress.

we can also read this article

What is a budget?https://www.nerdwallet.com/article/finance/what-is-a-budget

A budget is a spending plan based on income and expenses. In other words, it’s an estimate of how much money you’ll make and spend over a certain period of time, such as a month or year. (Or, if you’re accounting for the incoming and outgoing money of everyone in your household, that’s a family budget.)

3. Prioritize Needs Over Wants

Before making a purchase, ask yourself if it’s a need or a want. Needs are essentials like food, housing, and transportation, while wants are extras like eating out or new clothes. While it’s okay to treat yourself occasionally, prioritizing your needs will make saving easier.

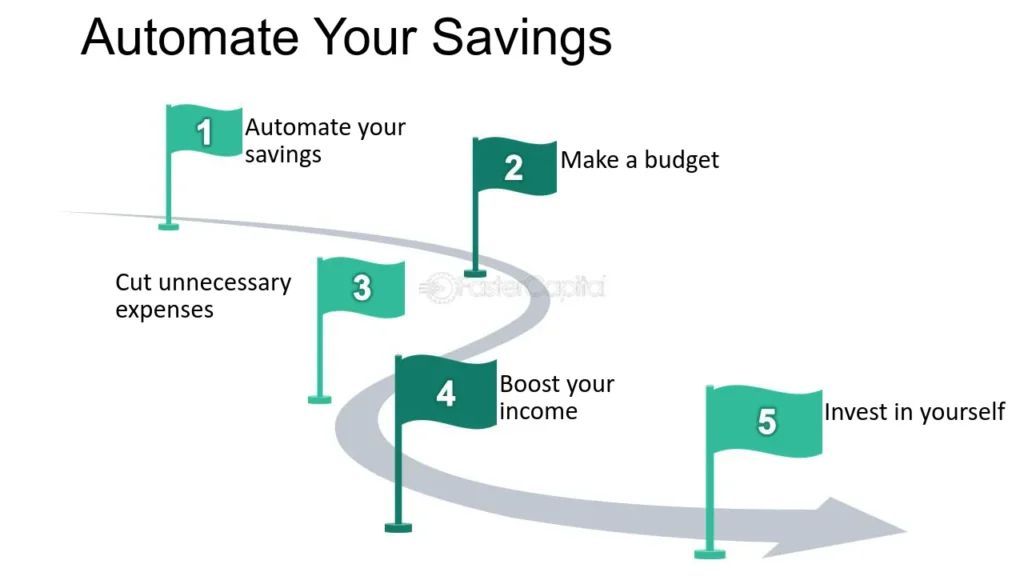

4. Automate Your Saving

Set up an automatic transfer to your savings account each month. Even a small amount adds up over time. This “pay yourself first” strategy ensures that you’re consistently saving without the temptation to spend that money elsewhere.

5. Practice the 24-Hour Rule for Impulse Buys

If you see something you want to buy, give yourself 24 hours to decide. Many times, the urge to buy will fade, and you’ll realize you don’t need it. This habit can help you cut down on impulse purchases and make smarter decisions.

6. Make Use of Cashback and Rewards Programs

Sign up for cashback or rewards programs on purchases you make frequently, such as groceries or gas. Just make sure you’re not overspending to earn points—use these programs on things you buy anyway.

7. Buy in Bulk (When It Makes Sense)

Purchasing non-perishable items in bulk, such as cleaning supplies or toiletries, can save you money in the long run. Just ensure you’re buying items you’ll actually use to avoid wasting money.

8. Cook at Home More Often

Eating out can quickly add up. Planning and cooking meals at home not only saves money but is often healthier, too. Try cooking larger portions to enjoy leftovers, which can help reduce the number of times you need to cook during the week.

Monthly subscriptions for streaming services, magazines, or fitness apps can add up without you even realizing it. Review your subscriptions regularly and cancel those you’re not using. Consider sharing subscriptions with friends or family to cut costs.

The minimalist approach encourages focusing on quality over quantity. Before making a purchase, ask yourself if the item truly adds value to your life. By buying only what you need and will genuinely use, you’ll save money and reduce clutter.

Conclusion

Smart spending is about making mindful decisions with your money. By integrating these practical habits into your life, you’ll start to see savings accumulate without feeling deprived. Remember, every small step counts on your path to financial wellness.